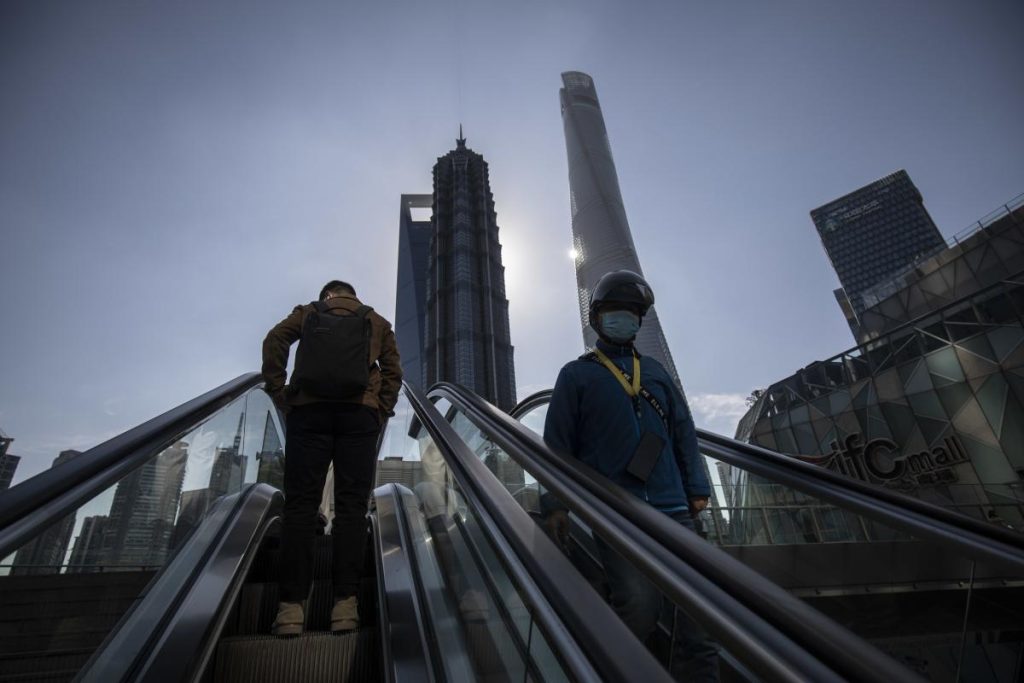

(Bloomberg) — After nearly two years of disappointment and losses of $6 trillion, speculation that the bottom of Chinese stocks has finally hit a massive rally this week.

Most Read From Bloomberg

A flurry of market-friendly headlines — along with unverified talk about China’s willingness to exit its tough Covid Zero policy — pushed the Hang Seng China Enterprises index to its best weekly gain since 2015. Led by tech names, the metric climbed to some highs. up 8.8% on Friday, as Bloomberg News reported progress in efforts to prevent hundreds of Chinese stocks from being delisted from US exchanges.

While all similar advances have fizzled out in recent months, bulls are betting that some of the world’s lowest valuations have Chinese stocks poised to rise at any hint of good news. The danger is that they may get ahead of themselves, especially after the country’s top health authority reaffirmed its commitment to Covid Zero.

Said David Chow, global market strategist for Asia Pacific previously in Japan at Invesco Ltd. On valuations and that a lot of bad news has been put into these stocks, investor sentiment is more bullish than bearish.”

The brutal recovery is taking place just one week after a historic defeat sparked by concerns about President Xi Jinping’s power grab at the Communist Party Congress. And while those losses came after a carefully curated leadership summit, the gains in the past days – after four months of losses for major indexes – were driven by leaks from reopening rumors.

“Rebounds driven by short-term pressure tend to be short-lived and a lot of foreign investors are still looking to sell because they are unsure of the outlook,” said Grace Tam, senior investment advisor for Hong Kong at BNP Paribas Wealth Management. “For investors who don’t mind volatility, reopenings and amortization make sense but you should be able to take on the risks.”

Read: How a mysterious Chinese screenshot spurred a $450 billion rise

Hong Kong’s Hang Seng rebounded nearly 9% this week, posting its best gains since 2011. The CSI 300, the benchmark index of mainland stocks, also jumped more than 3% on Friday. The Nasdaq Golden Dragon China Index of US-listed Chinese stocks also rose 7.5% in the first four days of trading.

The optimism extended to the currency and commodity markets, as the offshore yuan rose more than 1% in one phase, while iron ore futures rose. Dollar bonds of Chinese technology companies have also been sold in recent weeks, but their spreads narrowed by about 10 basis points on Friday, according to credit traders.

Shares related to the reopening, such as Li Ning Co. and Haidilao International Holding Ltd. Among the biggest gainers in the market. Bloomberg News also reported that China is working on plans to scrap a system that penalizes airlines for bringing virus cases into the country.

Shares of the two Internet giants, Alibaba Group Holding Ltd., rose. and Tencent Holdings Ltd. at least 7% each at closing. Dozens of US Public Accountability Oversight Board inspectors are scheduled to leave Hong Kong this weekend, earlier than their original mid-November schedule, people familiar with the matter told Bloomberg News, asking not to be identified because the information is private. .

The sudden rally has taken over the short sellers, who earlier bought contracts to profit from deeper dips in the Hang Seng China Enterprises scale.

However, the feeling of happiness did not stop the exodus of foreign money. There was 5 billion yuan ($687 million) in net sales this week through trade links with Hong Kong, adding to the 13 billion yuan last week, according to data compiled by Bloomberg.

Weller Chen, analyst at Forsyth Bar Asia Ltd., said: “With so many positive rumors in the market and indexes seeing a comfortable rally, there are a lot of rumours. Nothing has been confirmed but people are buying this advice.”

Assisted by Abhishek Vishnui, Dorothy Chan, Charlotte Young and John Cheng.

© Bloomberg LP 2022

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

Couple Accidentally Shipped Their Cat With Amazon Returns – 1 Week and 3 'Miracles' Later They Were Reunited

Microsoft opens data center in Thailand amid Southeast Asia expansion

ExxonMobil has reached an agreement with the Federal Trade Commission and is set to close its $60 billion Pioneer deal