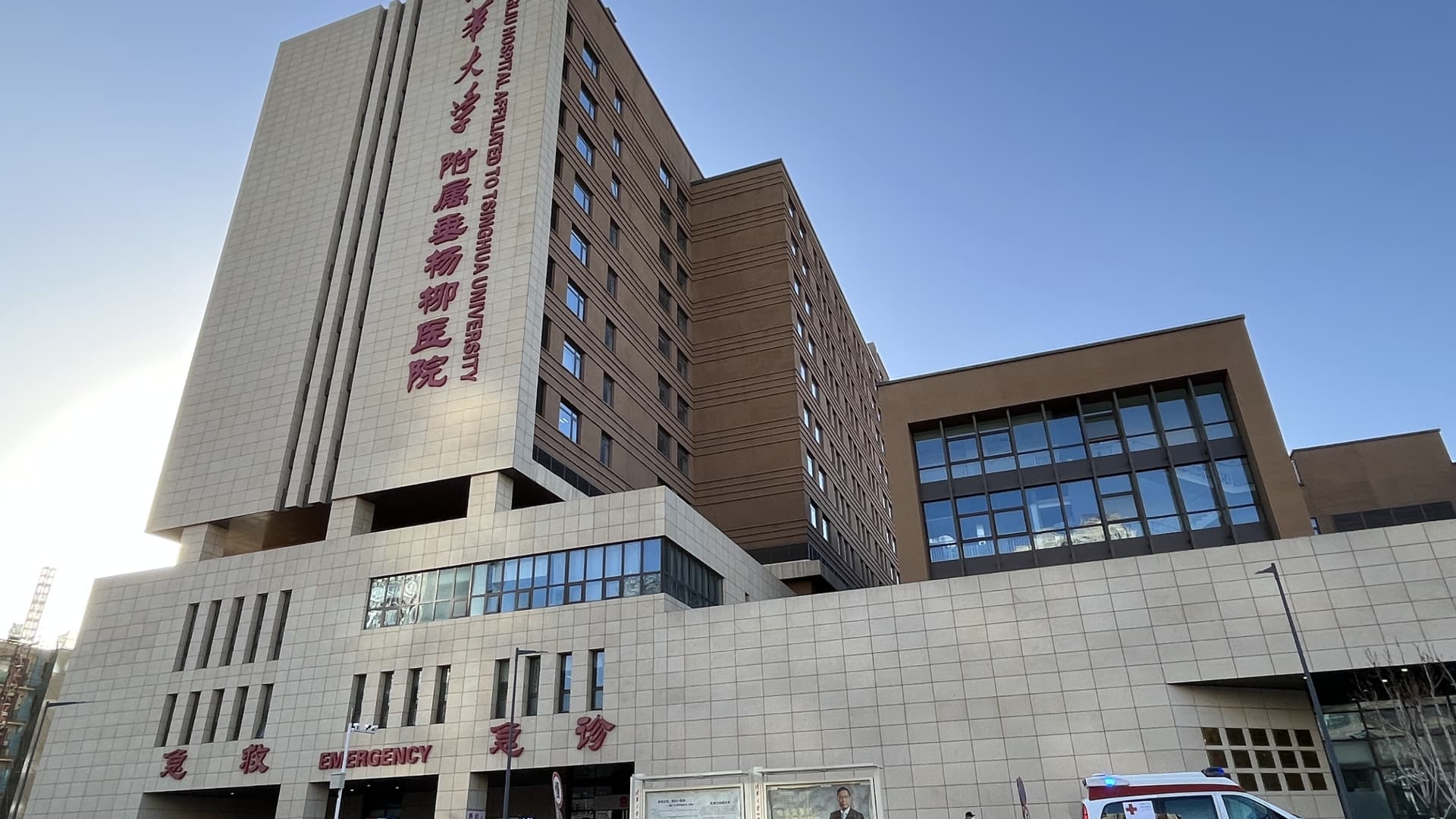

Chuiyangliu Hospital, pictured in January 2023 in Beijing, has in the past few years finished renovations that have allowed daily patents to increase sixfold to 5,000 per day, according to official estimates.

Yin Hun Chau | CNBC

BEIJING — Health, sports and wellness top the shopping list for anyone in their late 20s or older in China. This is according to an Oliver Wyman survey late last year, as China finally began to wind down its Covid controls.

For people who plan to spend more on that health category, in December 47% said they plan to spend more on health insurance. This is higher than the 32% increase in October, the report said.

Related investment news

“There is a much bigger health concern after this latest wave, but after the whole pandemic, the health awareness of the Chinese consumer has increased a lot,” said Kenneth Chow, director of Oliver Wyman.

The survey found that even for people in their early 20s, health comes second to their plans to spend more on food. The study ranked the categories by the percentage of respondents who said they planned to spend more on each item, minus the percentage of respondents who planned to spend less.

The pandemic has put pressure on hospitals around the world. But China’s situation – especially since the spike in Covid cases in December – has exposed the gap between the domestic public health system and the weight of the global economy in a country second only to the United States.

The United States ranks first in the world in per capita health spending, at $10,921 in 2019, according to the World Bank. For China, the same figure was $535, which is similar to the figure in Mexico.

World Bank data showed that households in China also pay a higher percentage for their healthcare — 35.2% versus 11.3% for Americans.

Severe pressure on public hospitals – including a lack of capacity – has pushed many new patients into Covid and non-Covid care to facilities run by United Family Healthcare in China, said its founder, Roberta Lipson. She said her company has 11 international-standard hospitals and more than 20 clinics in major Chinese cities.

“The growth in awareness of the importance of secured access to health care, as well as UFH as an alternative provider, is driving demand for our services from patients who can afford self-care,” she said.

“This experience is also driving a growing interest in commercial health insurance that can cover access to premium private providers,” Lipson said. “We help patients understand the benefits of commercial insurance. This will have a lasting impact on the demand for private healthcare services.”

New Frontier Health, of which Lipson is vice president, acquired United Family Healthcare from TPG in 2019.

In early December, mainland China abruptly ended its strict Covid contact tracing measures. Official data showed that infections rose, with the number of hospitalizations reaching 1.6 million nationwide on January 5.

Between December 8 and January 12, Chinese hospitals saw nearly 60,000 COVID-related deaths — most of them elderly people, according to Chinese health authorities. By January 23, the total had passed 74,000, According to CNBC estimates from the official data.

Although new deaths per day are down sharply from the peak, the numbers do not include Covid patients who may have died at home. The tales depict a public health system overwhelmed with people at the peak of a wave, and long waiting times for ambulances. Doctors and nurses have been working overtime in hospitals, sometimes while they themselves were sick.

health insurance

Most of the 1.4 billion people in China enjoy so-called social health insurance, which provides access to public hospitals and reimbursement for medicines on a state-approved list. Both employers and their employees contribute regular payments to the government-run system.

Other health insurance penetration — including commercial plans — was just 0.8% as of the third quarter of 2022, according to S&P Global Ratings.

Analyst WenWen Chen expects commercial health insurance to grow rapidly this year and next. “After Covid, we see people’s awareness of the risks increasing [health insurance] agents, it is easier for them to have conversations with customers.”

Some of the players in the health insurance industry in China include: Ping AnAnd PICC peripherally inserted central catheter And aia. Local authorities are also testing a low-cost insurance product called Huimin Bao.

An Oliver Wyman survey in December found that 62% of non-policyholders planned to purchase health insurance, and 44% of existing policyholders were considering increasing their coverage.

Over the past fifteen years, the Chinese government has devoted financial and political resources to developing the country’s public health system. The topic was an entire section in Chinese President Xi Jinping’s report at a major political meeting in October.

Hospital financing

However, one of the barriers to improving China’s public health system is its fragmented financing system, according to Chengyu Ming, executive director at the China Center for Health Development Studies at Peking University.

Healthcare providers in China receive funding from four sources — social health insurance, the state health budget, basic public health programs and personal payments — each “run by different authorities without effective coordination in budget management and allocation,” Meng wrote in the paper. The Lancet in December.

He said that “hospitals and clinics are reluctant to provide public health care due to the absence of financial incentives and the large number of regulations,” which further separates[s] hospitals and [specialized public health organizations such as the Centers for Disease Prevention and Control]. “

For comparison, HCA Healthcarethe largest hospital operator in the United States more than half of its revenue It comes from managed care — often company-backed plans that have a network of health providers — and other insurance companies. Most of HCA’s other revenue comes from government-related Medicare and Medicaid health insurance plans.

In China, Lipson of United Family Healthcare claimed that being a privately managed company allowed it to react more quickly. “We fund our own growth and can acquire talent and experience by offering competitive pay packages, so we can also flex the family to the required level of care.”

“After we noticed the course taken by the increase in the epidemic in other countries, and because our patients are paid privately, we were able to request adequate supplies of medicines, PPE, etc., as we started to see the number of Covid cases increase in China,” he said.

Her company had excess capacity at the start of the pandemic since it opened four hospitals in the past two years, Lipson said, noting that the public system has added 80,000 ICU beds over the past three years, but has struggled to meet demand from the surge. In cases of covid.

Shortage of specialist doctors

Ultimately, the shock of the pandemic provides an opportunity for broader changes in the industry.

George Jiang, a consulting director at Frost & Sullivan, said the healthcare payment system has no direct impact on Chinese hospitals, because most of them are directly under government supervision.

But he said macro events can lead to needed systemic changes, such as tripling ICU capacity in one month.

Jiang said China’s tiered medical system has forced doctors to compete for only a few advanced intensive care departments in the largest cities, leading to a shortage of qualified intensive care doctors and thus a shortage of beds. He said recent changes mean that smaller cities now have the capacity to hire such specialist doctors – a situation not seen in China in the past 15 years.

Now with more intensive care beds, it is expected that China will need to train more doctors for this level of care.

There are many factors behind the development of healthcare in China, and why local people often go abroad for medical treatment.

But Jiang noted that greater use of the internet for payments and other services in China versus the United States means the Asian country could become the most advanced market for medical digitization.

Chinese companies already in the space include JD Health and WeDoctor.

— CNBC’s Dan Mangan contributed to this report.

Correction: This story has been updated to reflect that Roberta Lipson is the founder of United Family Healthcare and vice president of parent company New Frontier Health.

“Professional web geek. Alcohol fan. Devoted zombie trailblazer. Certified social media lover. Amateur creator. Friendly food nerd.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546355/intel_13900k_tomwarren__2_.jpg)

More Stories

LIVE UPDATES: Paris Olympics opening ceremony goes ahead despite French rail attacks

Three Russian Shahed drones hit Romania, causing fire, sources say

Harris campaign vets VP slate that includes Whitmer, Kelly, Cooper