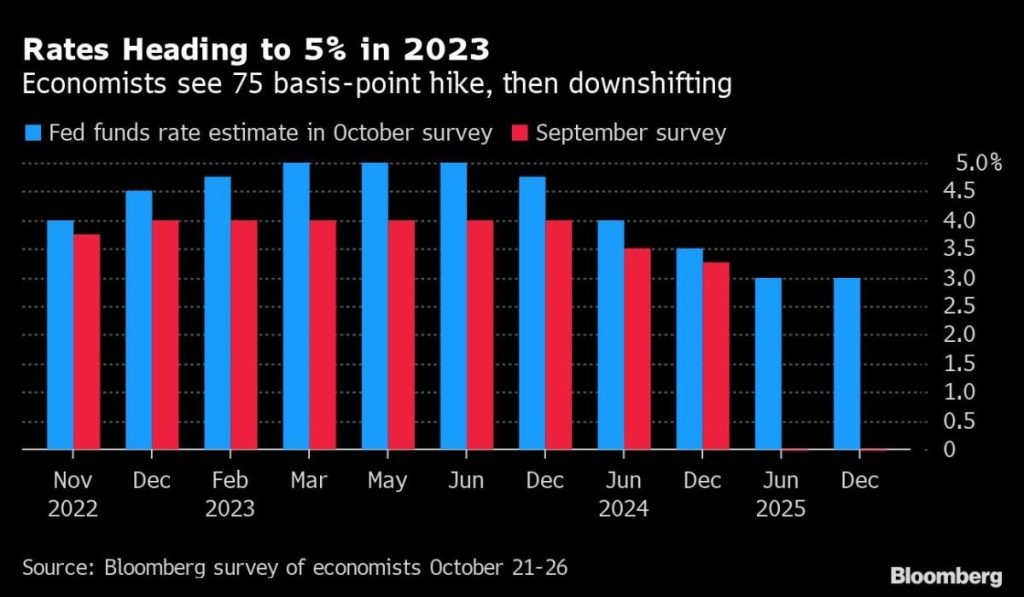

Economists polled by Bloomberg said, in a Bloomberg survey, that Fed officials will maintain their hawkish stance firmly next week, paving the way for interest rates as high as 5% by March 2023, moves that are likely to lead to a US and global economic recession. .

Most Read From Bloomberg

The survey found that the Federal Open Market Committee will raise interest rates by 75 basis points for the fourth consecutive meeting when policy makers announce their decision at 2 p.m. in Washington on Wednesday.

Officials got additional reason to continue the path when US government data on Friday showed employment costs rose at a steady pace in the third quarter and that the central bank’s preferred inflation measure was still well above its 2% target.

Rates in the survey are expected to rise by another half a point in December, and then by a quarter point in the following two meetings. The Fed’s forecasts released at the September meeting showed rates as high as 4.4% this year and 4.6% next year, before cuts in 2024.

Economists are of the view that the Fed is determined not to pivot too soon as it fights inflation at a 40-year high. The shift to a higher peak rate will reflect consumer price growth, excluding food and energy, which has come in much hotter than expected over the past two months. The poll of 40 economists was conducted from October 21 to 26.

“Inflation pressures remain severe, and the Fed is set to rise by 75 basis points in November,” James Knightley, chief international economist at ING Groep NV, said in response to the survey. December given the weak economic and market background, “but risks are skewed towards a fifth increase of 75 basis points,” he said.

Federal Reserve Chairman Jerome Powell said the central bank was deeply committed to restoring price stability and repeatedly cited his predecessor Paul Volcker, who raised interest rates to unprecedented levels to counter inflation in the early 1980s. Powell warned that the process will be painful, because the goal is to engineer sub-trend growth to reduce price pressures and unemployment will rise as a result.

Powell and his colleagues have not lost hope that they can achieve a smooth landing for the economy. But for the first time in opinion polls ahead of the FOMC meeting, a majority of economists – three-quarters – see a possible recession over the next two years, and most of the rest see a hard landing with a zero period. or negative growth in the future.

What Bloomberg Says About Economics…

“I think the most important thing to watch is how Powell communicates a potential downward shift in the pace of rate hikes. He will want to avoid giving the impression that pivots are imminent, particularly when core inflation is still strong. He will prepare the markets for a 50 basis point hike in December but will also be accompanied by a point chart, which shows an interest rate of 5%.

Anna Wong, Chief American Economist

Economists see the Fed may be overly tightening: The average economist will set a peak rate target at 4.75%, and 75% of economists said there is a greater risk that the central bank will raise rates too much and cause undue pain than not to do that. He raised enough and failed to contain inflation.

“Lagging in monetary policy continues to be underestimated,” said Thomas Kostig, chief US economist at Pictet Wealth Management. “The full impact of the current tightening may not be felt until mid-2023. By that time, it may be too late. The risk of a policy error is high.”

There could be indirect economic repercussions on global markets, with two-thirds predicting a global recession in the next two years.

While the median economist is looking for a 50 basis point increase in December, it is close, with nearly a third up 75 basis points.

The price path that economists predict is similar to that predicted by the markets. Investors are fully expecting a 75 basis point increase on Wednesday, leaning towards a 50 basis point hike in December and looking for prices to peak around 4.8%.

If the Fed offers another 75 basis point move next week, the combined 375 basis point increase since March would mark the largest Fed rate hike since the 1980s when Volcker was president and was battling high inflation.

“With the Fed facing the choice of doing too much or too little, members are likely to choose to do too much,” said Joel Naroff, president of Naroff Economics LLC, with the aim of avoiding the continued inflation that Volcker faced from the 1970s.

Economists expect the Fed to continue with the announced cuts to its balance sheet, which began in June with the run-off of maturing securities. The Fed is reducing assets by as much as $1.1 trillion annually. Economists expect the balance sheet to reach $8.5 trillion by the end of the year, declining to $6.7 trillion in December 2024.

There is significant division over whether the Fed will move to sell mortgage-backed securities as part of the cuts, with 57% anticipating such a move and no consensus on the timing.

The FOMC statement is expected to retain its language providing guidance on interest rates promising continued increases, without specifying the size of the adjustments, although the quarter is looking for softer language indicating lower hikes.

Nearly a third of economists expect opposition at the meeting, which will be the third of 2022. Kansas City Fed President Esther George vetoed in June in favor of a smaller increase, warning that too abrupt changes in interest rates could undermine the Fed’s ability To achieve the planned price path. Louis Fed President James Bullard defected in March as a hawk.

Combined with slower rate hikes, economists argue that the Fed will eventually reverse course in response to lower growth and inflation. Most see a slight decrease in the first rate in the second half of 2023, with larger cuts in 2024.

(Updates with labor cost index and PCE data in third paragraph.)

Most Read From Bloomberg Businessweek

© Bloomberg LP 2022

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

The former flight attendant who became the first female president of Japan Airlines

The Fed's main measure of inflation rose 2.8%

The Bank of Japan keeps its monetary policy unchanged