(Bloomberg) — Asian stocks swung between gains and losses, with sentiment weighed down by weak Chinese data and optimism over reports that the country will start selling long-term bonds.

Most read from Bloomberg

Hong Kong’s stock index rose to its highest level since August, and stocks in mainland China also rose. But stocks in South Korea, Japan and Australia fell. China’s 1 trillion yuan ($138 billion) private bond issuance program is scheduled to begin on Friday, and will eventually include 20-, 30- and 50-year debt. European stock futures were little changed.

News of China’s planned debt issuance boosted sentiment after weak data from the country published over the weekend led to initial losses in Asian stocks. The specter of additional US-China trade tensions also weighed on stocks with a report on how willing President Biden is to increase tariffs on Chinese electric vehicles.

“You’re looking at a slightly distorted growth outlook for China,” Sonal Desai, chief investment officer at Franklin Templeton, said in an interview with Bloomberg TV. He added that regardless of who is elected in the US presidential elections in November, we will see an escalation in trade tensions between the United States and China.

There was little change in the Bloomberg index for the dollar and the euro. Japanese bonds fell after the central bank offered to buy a smaller amount of government debt than at a previous auction. The yield on 30-year bonds rose to their highest levels since 2011.

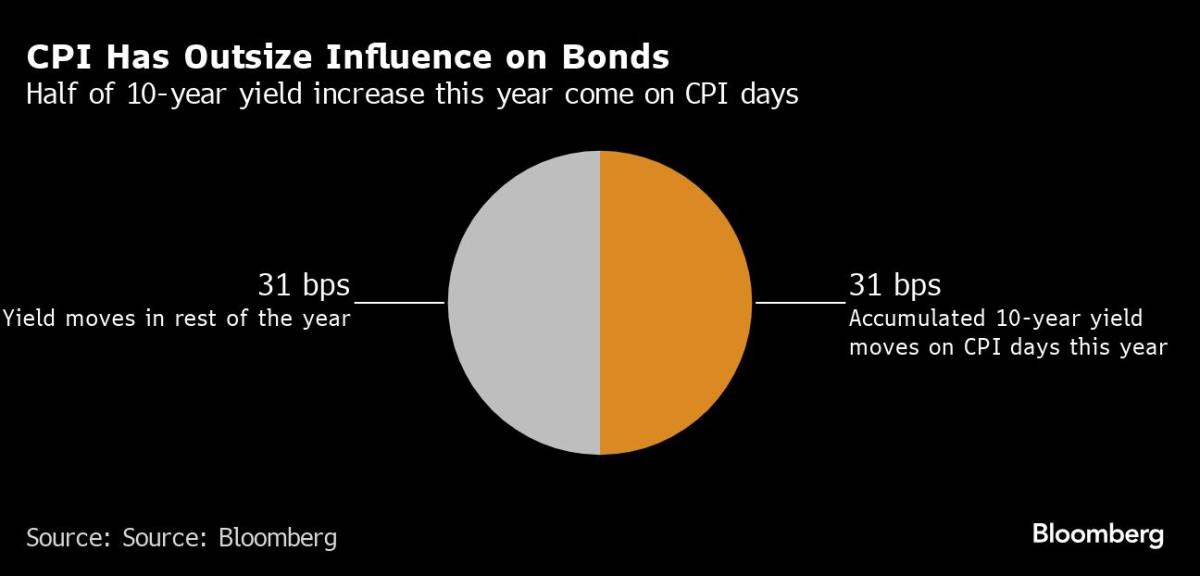

Potential key catalysts for markets this week include China’s interest rate decision on Wednesday and the US inflation reading for April on the same day.

Investors will also continue to scrutinize comments from US officials for signals on how long the Fed will keep interest rates at high levels. Dallas Fed President Lori Logan said last week it was still too early to consider cutting borrowing costs, while Governor Michelle Bowman said she did not expect it would be appropriate for the Fed to cut interest rates in 2024.

Read more: This round of inflation data will matter a lot: John Authers

Weak Chinese data weighed on oil on Monday, with commodity traders also eyeing the OPEC+ meeting on supply policy.

Iraqi Oil Minister Hayan Abdul Ghani initially said over the weekend that Baghdad had reduced its production enough and would not agree to more. But he later said that any decision is a matter for OPEC, and that it will adhere to whatever the group decides. OPEC+ meets on June 1.

Elsewhere this week, the euro zone is set to report inflation and growth figures while a host of Federal Reserve officials including Chair Jerome Powell are scheduled to speak.

Some key events this week:

-

Australian Business Confidence, Monday

-

Food prices in New Zealand, inflation expectations, Monday

-

India Trade, Consumer Price Index, Monday

-

Eurozone finance ministers meet in Brussels on Monday

-

Australia’s Budget 2024-25, Tuesday

-

Japanese Producer Price Index, Tuesday

-

German CPI and ZEW survey forecasts on Tuesday

-

UK Unemployment Claims, Unemployment, Tuesday

-

US Producer Price Index, Tuesday

-

Federal Reserve Chairman Jerome Powell and ECB Governing Council member Klaas Knott speak on Tuesday

-

Interest rate decision in China, Wednesday

-

Eurozone industrial production, GDP, Wednesday

-

US CPI, Retail Sales, Business Inventories, Imperial Manufacturing, Wednesday

-

Unemployment in Australia, Thursday

-

Japanese GDP, Industrial Production, Thursday

-

China real estate prices, retail sales, industrial production, Friday

-

Eurozone consumer price index, Friday

Stores

-

S&P 500 futures were little changed as of 6:36 a.m. London time

-

Nasdaq 100 futures rose 0.2%

-

Dow Jones Industrial Average futures were little changed

-

There was little change in the MSCI Asian stock index

-

MSCI Emerging Markets Index rises 0.2%

-

S&P 500 futures were little changed

-

Nikkei 225 futures fell 0.3%

-

Japan’s Topix index fell 0.2%.

-

Australia’s S&P/ASX 200 index fell 0.1%.

-

The Hang Seng Index in Hong Kong rose 0.7%.

-

The Shanghai Composite Index was little changed

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

There was little change in the euro at $1.0774

-

The Japanese yen was unchanged at 155.78 to the dollar

-

There was little change in the yuan in external transactions at 7.2409 to the dollar

-

There was little change in the pound sterling at $1.2531

Digital currencies

-

Bitcoin fell 0.5% to $60,959.31

-

Ethereum fell 1.3% to $2,885.17

Bonds

-

The yield on 10-year Treasury bonds was little changed at 4.49%.

-

The yield on 10-year German bonds rose two basis points to 2.52%.

-

The yield on British 10-year bonds rose two basis points to 4.17%.

-

The yield on Australian 10-year bonds rose two basis points to 4.34%.

Goods

-

Gold in spot transactions fell 0.3 percent to $2,352.52 per ounce

-

West Texas Intermediate crude fell 0.3 percent to $77.99 a barrel

-

Gold in spot transactions fell 0.3 percent to $2,352.52 per ounce

This story was produced with assistance from Bloomberg Automation.

–With assistance from Ishika Mukherjee.

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

Kamala Harris likely to share her stance on Bitcoin in coming weeks – industry optimists note her husband is a ‘crypto guy’

Elon Musk: Trump Presidency Could Hurt Tesla’s Competitors

GM’s very strong quarter was overshadowed by potential industry headwinds