Official data showed, on Wednesday, that the annual inflation rate jumped to 7.0% in March from 6.2% in February, the highest level since March 1992 and more than expected by most economists in a Reuters poll.

The month-on-month rise was the highest this time of year since ONS records began in 1988. Large price increases, which range from vehicle fuel to food and furniture, were behind the increase.

Families are facing the biggest cost-of-living pressure since records began in the 1950s, according to British budget forecasts, and overshooting inflation is another bad news for the government as well.

Police fined Johnson and Sonk on Tuesday for attending Johnson’s birthday party in June 2020 at his Downing Street office at a time of COVID-19 restrictions, leading to calls from political opponents to resign.

Sunak – previously seen as a leading candidate to succeed Johnson as prime minister – saw his popularity plummet after his March budget statement, which the public deemed did little to ease cost-of-living pressures.

After the data, Sunak said: “I know this is a worrying time for many families which is why we are taking action to ease the burden by providing support of around £22 billion ($29 billion) in this financial year.”

Sunak will be pressured to do more, said Jack Leslie, chief economist at Resolution Research.

“The sheer scale of this inflation-led pressure on living standards makes it all the more clear how little support the Chancellor provided in the Spring Statement – a decision that will certainly have to be reconsidered before the fall budget,” Leslie said.

British inflation has seen an unprecedented rise over the past year, following a pattern similar to most other advanced economies as energy prices soar and pandemic difficulties in the supply chain persist.

Russia’s invasion of Ukraine on February 24 sent energy prices soaring, and Britain’s Office of Budget Responsibility last month predicted that inflation would peak at a 40-year high of 8.7% in the fourth quarter of 2022.

high rates

All financial markets are certain that the Bank of England will raise interest rates to 1% from 0.75% on May 5 before raising them to 2%-2.25% by the end of 2022, although many economists expect them to be less severe.

The Bank of England expects economic growth to slow sharply over the course of this year as cost-of-living pressures mount.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, forecast inflation would reach 8.8% in April after household utility bills rose, but then fall below the Bank of England’s 2% target in the second half of next year.

Wednesday’s data showed that core CPI, which excludes food, energy, alcohol and tobacco prices, rose to 5.7% in March from 5.2% in February.

Retail price inflation — an old measure that the Office for National Statistics says is inaccurate, but is widely used in commercial contracts and to determine interest payments on inflation-linked government bonds — rose to 9.0%, the highest level since 1991.

There were signs of more inflation pressures ahead as manufacturers increased their prices by 11.9% in the twelve months through March, the biggest jump since September 2008.

Raw material costs for manufacturers jumped by 19.2%, and the largest increase on records began in 1997.

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

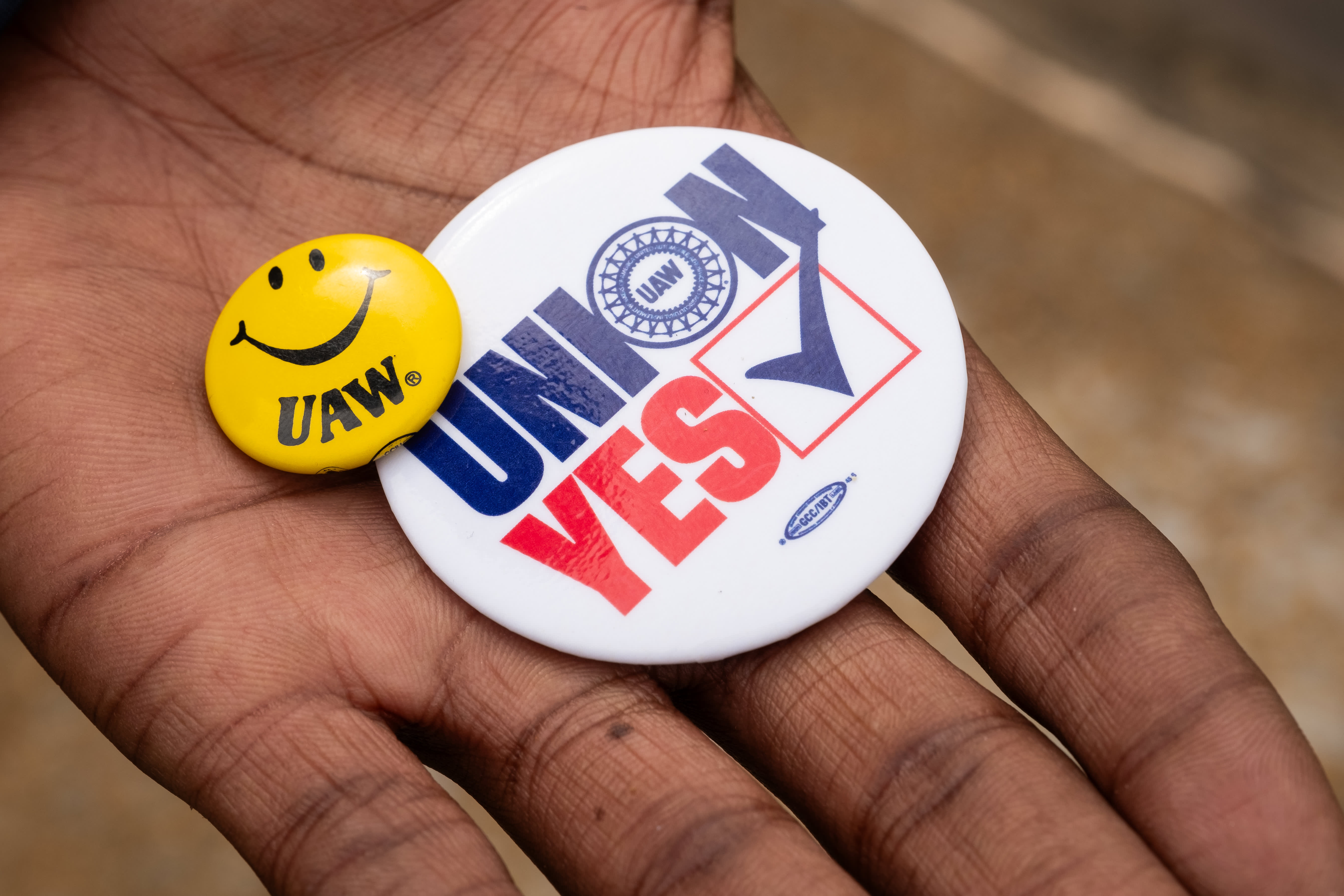

Volkswagen workers in Tennessee vote to join the UAW in a historic win for the union

Netflix stock falls on disappointing revenue forecasts, move to scrap membership metrics

The price of Bitcoin (BTC) has risen as the halving approaches