The once-hot company reported a dismal quarterly financial report on Tuesday, with sales down 15% from a year ago. Peloton lost $757 million last quarter.

As people return to the gyms, Peloton has struggled to maintain its electric growth since the early days of the pandemic. Bicycle sales and subscriptions stagnated. The company has a very large inventory, and the demand is declining.

“Transitions are hard work,” McCarthy told investors in a letter to shareholders. “It’s intellectually challenging, emotionally exhausting, physically exhausting, all exhausting. It’s a full contact sport.”

But the company’s return – if there is one – is slower than Wall Street wants. Peloton added just 195,000 new subscribers last quarter, less than half of what it was adding a year ago. The company said it will generate nearly $700 million in sales this quarter, far less than investors had expected.

Neil Saunders, managing director of GlobalData, said in a note to investors that Peloton’s $757 million loss is “extremely bad” and “underscores the enormity of the mission heart of the business.”

“It is reasonable to assume costs could be reduced further, but even with these future savings, Peloton will remain, at best, a low-profit company with a poor return,” he added.

Peloton shares are down 15% in early trading. The stock is down about 90% since hitting an all-time high in late 2020.

To stay afloat, McCarthy said Peloton is borrowing $750 million in five-year debt from JPMorgan and Goldman Sachs, two banks that helped secure the initial public offering.

“I want to thank everyone involved in the hard work in completing this important funding and look forward to reporting on the progress we’ve made in reshaping the Peloton business in the coming quarters,” McCarthy said.

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

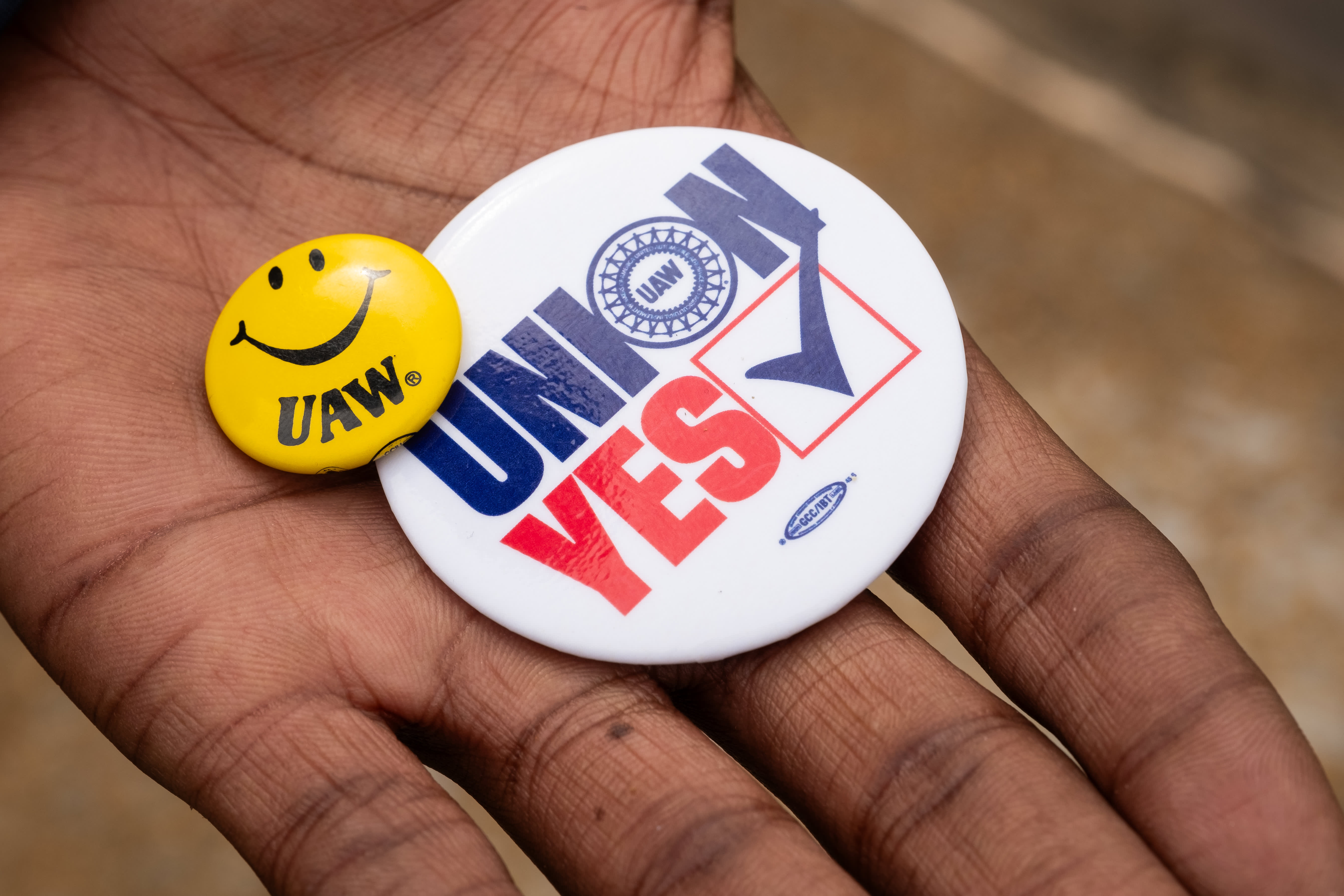

Volkswagen workers in Tennessee vote to join the UAW in a historic win for the union

Netflix stock falls on disappointing revenue forecasts, move to scrap membership metrics

The price of Bitcoin (BTC) has risen as the halving approaches