Stocks on the go: Greggs and Accelleron rise 5%

A share of the British bakery chain Greg Gaining 5.6% in early trade after reporting a rise in quarterly sales despite a worsening cost-of-living crisis and waning consumer confidence in the UK

Axelron Shares are up 5% as investors pick the stock at a discount after the first ABB The weak market for the turbocharged unit debuted on Monday.

CNBC Pro: Want a ‘defensive move’ with a 5% return? Buy this fund, says the strategist

It’s been a volatile year for both stocks and bonds, with only Wall Street’s major indices Ending her worst month since March 2020Treasury yields remain high.

However, David Dietz, chief investment strategist at Point View Wealth Management, says “pockets of opportunity” remain.

“Short-term defensive measures are likely justified,” Dietz said in an interview with CNBC’s “Street Sings Asia” on Monday, and he chose his favorite box to play in the market now.

Professional subscribers can read more here.

– Weezin Tan

See more Q4 earnings guidance than actual Q3 numbers, S&P Global says

Standard & Poor’s Global believes that the fourth-quarter earnings forecast that companies provide when reporting third-quarter results will be more important to future market direction than the actual third-quarter numbers themselves.

“October is bringing in profits, with third-quarter estimates already down 7%, and the whisper numbers are a bit more than that,” Howard Silverblatt, chief index analyst, wrote over the weekend. “The biggest concern (from the actual numbers for the third quarter, when consumers were still spending) is the guidance for the fourth quarter, where consumers have fallen, inflation has continued, and the Fed’s ‘adjustments’ will have a greater impact.”

Third-quarter earnings for the S&P 500 are expected to grow 6.1% compared to the same quarter last year, and about 18% during the second quarter of 2022, according to S&P Global.

Next year estimates are for 14.3% earnings growth through 2022, and a P/E ratio of 15.0%.

Silverblatt also looked at the typical performance of the S&P 500 in October. “Historically, the index has gained 57.4% of the time, with an average gain of 4.18% for bullish months, average decrease of 4.67% for low months, and an average overall decrease of 0.46%,” he wrote.

– Scott Schneper

CNBC Pro: Here’s what’s next for stocks, according to Wall Street professionals

We’re finally over September, to the relief of many stock investors who endured a difficult month, as all major US indices posted heavy losses.

With a historically weak month now firmly in the rearview mirror, what is the outlook for stocks as we enter the fourth quarter of the year?

CNBC Pro has combed through the research to see what Wall Street thinks.

Professional subscribers can Read more here.

– Xavier Ong

European markets: here are the opening calls

European stocks are heading to open higher on Tuesday, benefiting from the gains seen in yesterday’s trading session.

The UK’s FTSE is expected to open 30 points higher at 6934, Germany’s DAX 126 index up at 12324, France’s CAC 40 by 58 points at 5850 and Italy’s FTSE MIB 245 points higher at 21043, according to data from IG.

The expected higher opening in Europe comes after a rebound on Wall Street on Monday. There, stocks rose to start the new month and quarter on a positive note, with Treasury yields plummeting from levels not seen in nearly a decade. It was the best day since June 24 for the Dow, and the best day for the S&P 500 since July 27.

Earnings come from Griggs on Tuesday and Eurozone producer price data for August.

– Holly Eliat

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

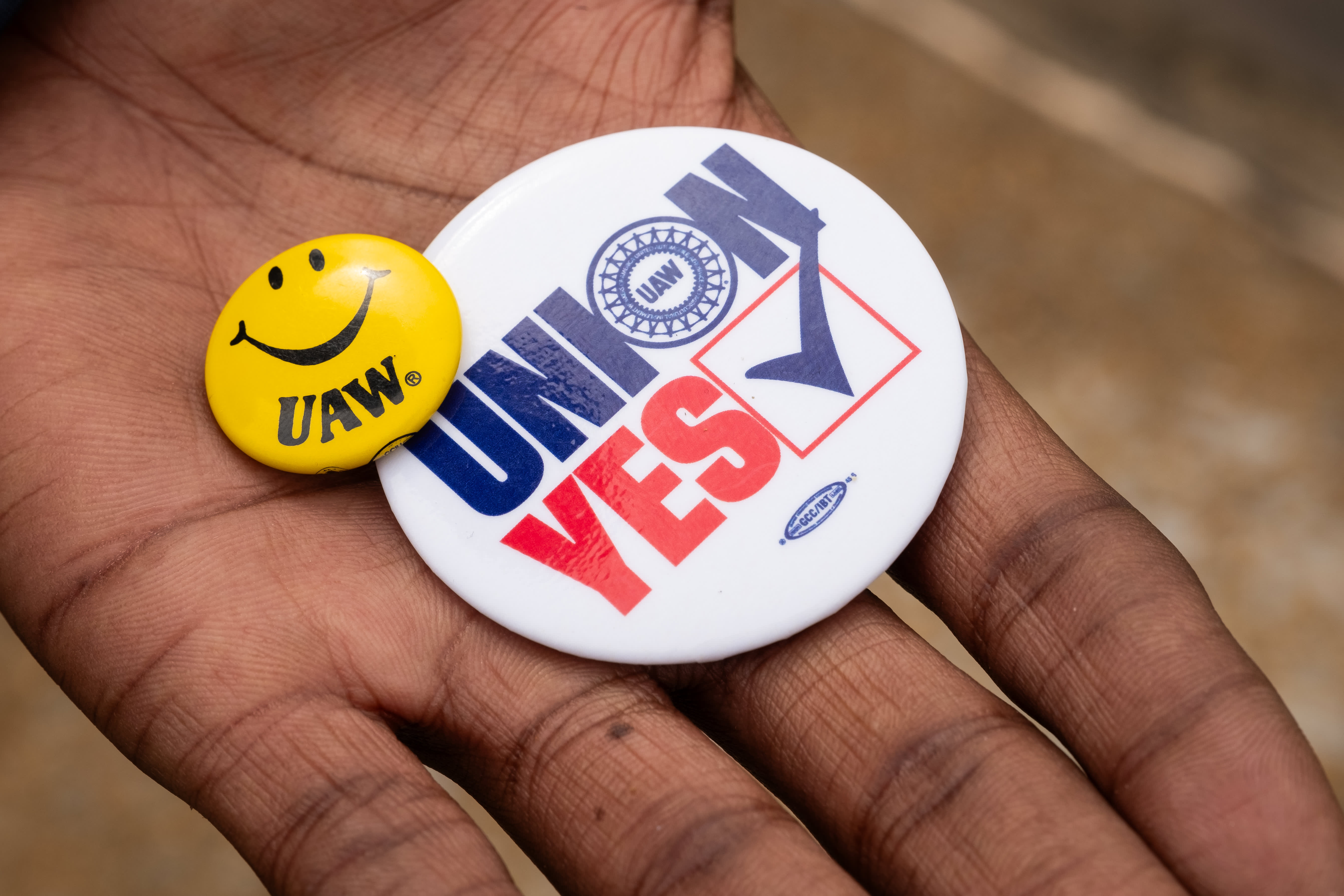

Volkswagen workers in Tennessee vote to join the UAW in a historic win for the union

Netflix stock falls on disappointing revenue forecasts, move to scrap membership metrics

The price of Bitcoin (BTC) has risen as the halving approaches