The Dow Jones Industrial Average fell on Wednesday, extending its losses after a difficult session on Tuesday. The 10-year Treasury yield jumped ahead of the release of the minutes of the March Federal Open Market Committee meeting this afternoon.

X

Simply good food (SMPL) reported its quarterly earnings results before Wednesday’s opening. Shares of Simply Good Inc. fell 1% in morning trading.

between the Dow Jones LeadersAnd the Microsoft (MSFT) And the Salesforce.com (CR) led the early pullbacks, down about 1.5% each. an Apple (AAPL) decreased more than 1% in Stock market today. chevron (CVX) Industrial sectors topped the rise of 1% with the rise in oil prices.

electric car giant Tesla (TSLA) slipped nearly 2% early Wednesday, adding to Tuesday’s sharp losses.

As the stock market’s upward trend is heading for increasing turmoil, Dow Jones is the financial leader American Express (AXP) – along with the alphabet (Google), from Broadcom (AVGO), IBD Leaderboard Inventory lovely ingredients (Dar: house), Regeneron Pharmaceuticals (Region) And the seashells (shill) – Top stocks to buy and watch on Wednesday.

Arista, Microsoft and Tesla IBD Leaderboard Stores. Darling components and Tesla stock appeared In this week Stocks near the buying area vertical.

Dow Jones today: Treasury yields, oil prices, Fed minutes

After Wednesday’s opening, the Dow Jones Industrial Average lost 0.85%, and the S&P 500 was down 1.2%. The tech-heavy Nasdaq is down 2% in morning trade.

in between Exchange Traded FundsNasdaq 100 Invesco QQQ Trust Tracker (QQQ(It lost 1.3%, the SPDR S&P 500 ETF lost)spy) is down 1% after Wednesday’s open.

On Tuesday, the 10-year US Treasury yield rose to 2.55%, hitting a 52-week high. Fed Governor Lyle Brainard, widely seen as one of the Fed’s most pessimistic members, said she expects rapid cuts to the Fed’s bloated balance sheet starting in May.

The 10-year yield continued its rally Wednesday morning, jumping to 2.64%, its highest level since March 2019. Meanwhile, US oil prices rose more than 1% on Wednesday morning with West Texas Intermediate crude falling above $103 a barrel.

Minutes from the Federal Reserve Policy meeting in March 2 p.m. EDT on Wednesday. On March 16, the Federal Reserve raised its key interest rate for the first time since 2018. Policymakers revealed their expectations for a total of seven quarter-point rate increases this year and at least three more in 2023.

Fed Chairman Jerome Powell said at his post-meeting press conference that the minutes will present the criteria for tightening the Fed’s balance sheet, canceling $4.5 trillion in asset purchases during the pandemic.

stock market rise

On Tuesday, the stock market underperformed, with the Nasdaq Composite losing 2.3%.

big picture column “The specific stock ended steadily in the red on Tuesday as Wall Street received another reminder that the Federal Reserve is intent on fighting inflation aggressively by raising interest rates and lowering the balance sheet,” he commented.

If you are new to IBD, consider taking a look at stock trading system And the CAN SLIM Basics. Distinguish chart patterns It is one key to investment guidance. IBD offers a wide range of Stock Growth ListsSuch as leaderboard And the SwingTrader.

Investors can also create watch lists, find companies near a profile buy pointor develop custom screens in IBD Market Smith.

Four Dow Jones stocks worth watching right now

Dow Jones Buy & Watch: American Express

Dow Jones Financial Stock American Express tracks a cup with a handle with 194.45 buy points. Shares fell 1.2% on Tuesday, closing above the 50-day moving average line. AXP shares were down 0.3% on Wednesday morning.

Watch the stocks line of relative strength. Amid its recent rally, the RS line is approaching its old highs, but there is still some work on it before a possible breakout. The RS line measures the performance of the stock price against the S&P 500 index. The RS line must reach a new high on the day of the breakout or shortly thereafter to confirm the strength of the stock’s breakout.

Four Growth Credits to Buy and Watch at Cursstock market rally

Stocks to buy and watch: Alphabet, Broadcom, Darling, Regeneron, Shell

Tuesday of 50 IBD stocks to watch Pick, Alphabet, nears 2,875.97 buy points in a cup with a handle, according to IBD Market Smith Graph analysis. GOOGL shares are just 1% away from entering amid Tuesday’s 1.2% loss. FANG stock is down 1.5% Wednesday morning.

Broadcom prices fell 3.3% Tuesday, as chip stock continued to hold above its early entry level of 614.74. Stocks set a new buy point, entry handle at 645.41. AVGO shares were down 1.5% Wednesday morning.

IBD Leaderboard Darling Ingredients stock finished Tuesday just under 80.31 cups with a buy point handle. Shares were down 2.5% on Wednesday morning.

Leading biotech company Regeneron Pharmaceuticals continues to have a buying range above 673.96 Flat Base Entry Following the breakout move on March 16th. REGN stock tested the buy point on March 23 before regaining the point of purchase on March 24 5% buying area It tops out at 707.66. Inventory was flat on Wednesday.

Oil and gas producer and Friday stock from IBD, Shell, is within walking distance of 56.23 buying points for a flat base despite Tuesday’s 1.6% drop. Shares jumped 1% on Wednesday morning.

Join IBD experts as they analyze the leading stocks in the current stock market rally on IBD Live

Tesla Stock

Tesla stock It slipped more than 2% early Wednesday, threatening to add to Tuesday’s 4.7% slide. The EV giant’s shares are approaching 1,208.10 cup base buying points and are about 10% away from the most recent entry. Meanwhile, Tuesday’s weakness may be the start of a proper trade that should provide a more optimal entry for risk.

The stock traded as high as 1,243.49 on November 4 and finished on Tuesday about 12% from its all-time high.

Dow Jones Leaders: Apple and Microsoft

in between Dow Jones stockApple shares fell 1.9% on Tuesday, falling back below a double bottom at 176.75 buying points. Buying space rises 5% to 185.59. AAPL stock is down more than 1% early Wednesday.

Software leader Microsoft fell 1.3% on Tuesday, as shares continued to build on the right side to form a new base. Microsoft shares were trading down 1.5% Wednesday morning.

Make sure to follow Scott Lehtonen on Twitter at Tweet embed Learn more about developing stocks and the Dow Jones Industrial Average.

You may also like:

Top growth stocks to buy and watch

Learn how to time the market with IBD’s ETF Market Strategy

Find the best long-term investments with IBD long-term leaders

MarketSmith: Research, charts, data, and training in one place

How to Find Growth Stocks: Why the IBD Tool Simplifies the Search for the Top % Stocks

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

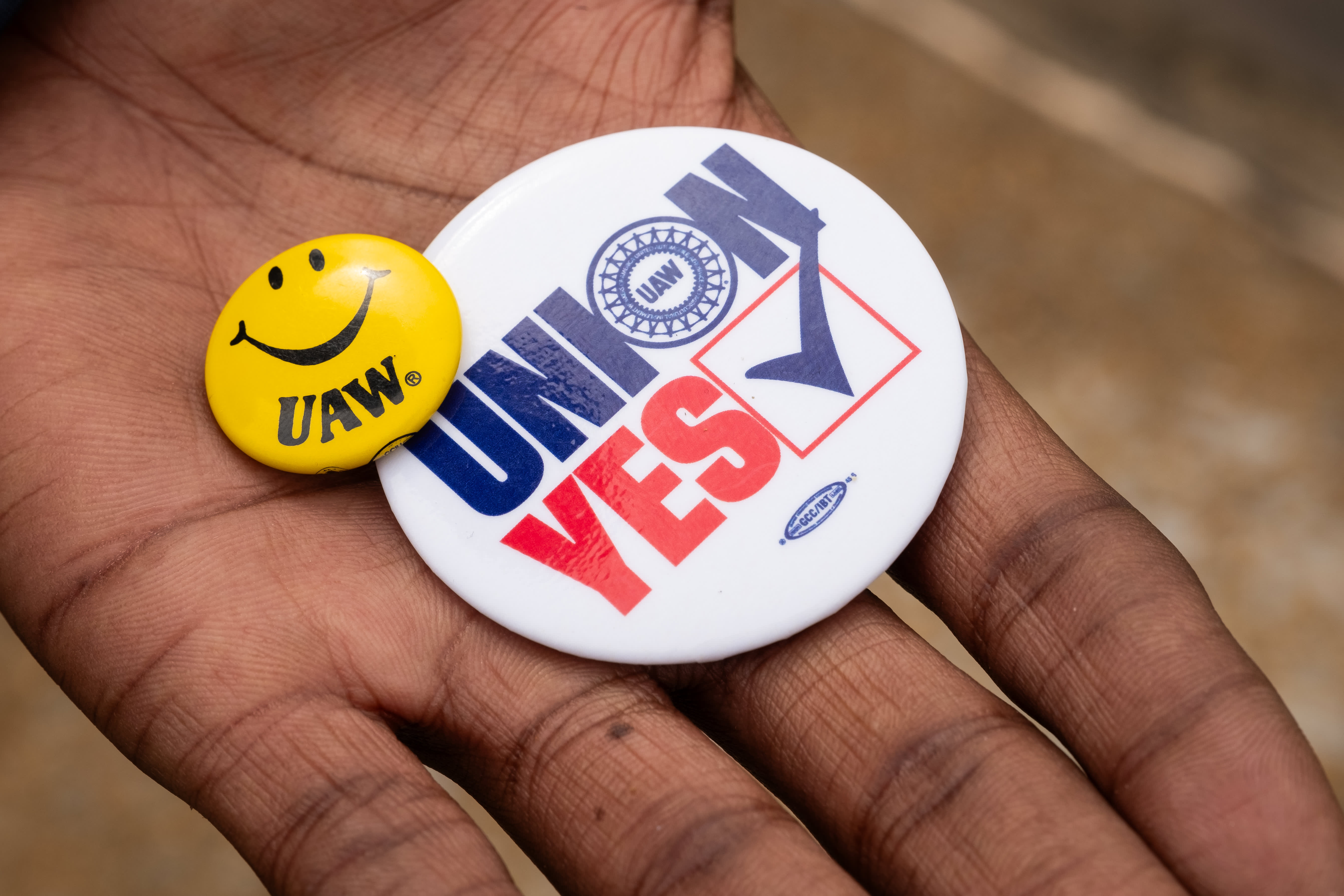

Volkswagen workers in Tennessee vote to join the UAW in a historic win for the union

Netflix stock falls on disappointing revenue forecasts, move to scrap membership metrics

The price of Bitcoin (BTC) has risen as the halving approaches