Friday morning Dow Jones futures rose slightly, along with S&P 500 and Nasdaq futures. Thursday saw a strong stock market rally, buoyed by the positive earnings feedback.

X

dollar tree (DLTR), Williams Sonoma (WSM) And Messi (M) Strong results and strong guidelines at least. More encouraging? Burlington stores (BURL) And nvidia (NVDA) rose despite the weak outlook. This indicates that markets are pricing in bad news from cost pressures, supply chain issues and hesitant consumers.

play lithium Albemarle (ALB) And Levent (LTHM) broke through the resistance zones, and the buy signals flashed. Delta Airlines (DA) rose above a violent entry point during Ashland International Holdings (ash) And WR Berkeley (WRB) Go to the top early buy points.

Main earnings

Costco Wholesale (recovery), Ulta Beauty (Ulta) And Zscaler (ZS) reported after closing.

Costco Earnings They were in line while sales beat estimates for the third quarter of the fiscal year. Shares are down 2% after rising 5.65% in Thursday’s regular session.

Ulta Beauty Earnings Beat EasilyWith revenue up 21%. ULTA stock jumped 7% overnight, indicating a gap above the 200 and 50 day lines. Shares have already rebounded 7.1% in the Thursday session.

Zscaler’s earnings won modestly, with the cybersecurity firm also providing upbeat guidance. ZS stock is up 1% in the extended trade. Shares rebounded 7.2% Thursday, but still close to an 18-month low.

ALB stock is running IBD Leaderboard. ASH stock was on Thursday IBD stock today. WRB stock was on Tuesday Today’s stock.

The video included in this article discusses an important day in the market and analyzes Ashland Global, cabot (CBT) and stock DLTR.

Dow jones futures contracts today

Dow futures rose 0.1% against fair value. S&P 500 futures rose 0.2% and Nasdaq 100 futures rose 0.3%.

The Commerce Department will release its Income and Consumer Spending Report for April at 8:30 a.m. ET, providing a comprehensive look at the health of consumer spending. The report’s inflation gauge is the Fed’s favorite.

Remember to work overnight in Dow Jones futures contracts and elsewhere that does not necessarily translate into actual circulation in the next regular session Stock market session.

Join IBD experts as they analyze actionable stock market actionable shares on IBD Live

stock market rise

The stock market rally gained rapid momentum on Thursday, with a solid advance for the major indices.

The Dow Jones Industrial Average rose 1.6% on Thursday stock market trading. The S&P 500 jumped 2%. The Nasdaq Composite Index rose 2.7%. Small Capital Earning Russell 2000 2.2%

Several stocks, including Nvidia and Burlington Stores, rose on Thursday despite poor guidance. It’s a welcome change from recent months when shares sold off apparently on good news. Indicates that the market has prices bad news and bearish fears and that it is ready to go higher.

Of course, it is never clear what the price is. the difference (GPS) And a work day (day) Glide overnight with poor results.

US crude oil prices jumped 3.4% to $114.09 a barrel.

The 10-year Treasury yield rose one basis point to 2.76%.

ETFs

between the Best ETFsThe Innovator IBD 50 ETF (fifty) rose 2.6%, while the IBD Breakout Opportunities ETF (Innovator)fit) jumped 1.85%. iShares Expanded Technology and Software Fund (ETF)IGV) made 2.1%. VanEck Vectors Semiconductor Corporation (SMH) rose 3.3% with NVDA holding a major stock.

SPDR S&P Metals & Mining ETF (XME) advanced by 1.3% and the US Global X Infrastructure Development Fund (ETF) )cradle) 2.2%. US Global Gates Foundation (ETF)Planes) rose 5.1%, with DAL stock maintaining a core. SPDR S&P Homebuilders ETF (XHB) popped 3.9%. SPDR Specific Energy Fund (SPDR ETF)XLE) by 1.1% and the Financial Select SPDR ETF (XLF) 2.3%. SPDR Healthcare Sector Selection Fund (XLV) rose 0.4%.

Shares reflect more speculative stories, the ARK Innovation ETF (see you) up 3.9% and the ARK Genomics ETF (ARKG) 1.3%.

Top 5 Chinese stocks to watch right now

Stocks in buying areas

Albemarle stock jumped 7.4% to 255.05 in heavy trading, clearing key resistance near 248 months ago. This is a legitimate entry into the depths cup base With an official buy point of 291.58. Late Monday, Albemarle sharply raised its full-year earnings guidance for the second time in less than a month. ALB stock briefly cleared the 248 area before pulling back.

The Relative force line It is at a new high, a bullish signal. The RS line, the blue line in the provided charts, tracks the stock’s performance against the S&P 500 Index.

Livent stock rose 6.8% to 30.20, removing resistance just below 30, providing an early entry. The official purchase point for the trophy base is 33.14. In early May, the lithium producer squashed views on earnings and lifted guidance. LTHM’s RS line reached a new high.

Delta stock rose 5.8% to 40.83, moving above the 50-day and 200-day lines as well as breaking the short trend line from the April 21 high at 46.27. Shares of DAL and other travel plays rebounded Thursday, boosted by increased revenue expectations from Southwest Airlines (love) And Jet Blue (JBLU).

Delta stock has hit resistance at the 45-46 area several times in the past year. The reinforcement since late April is on its way to being a proper base in another week. One can view this consolidation as a knob in a deep base that dates back to March 2021.

Ashland stock rose 4% to 105.76, breaking a downtrend in flat base And the extension of the retracement from the 50-day line. The flat base, which can be considered part of the consolidation going back to November, has 111.15 buy points. The RS line is the highest in nearly three years.

WRB stock rose 1.6% to 70.11, shedding short-term resistance just above 69, providing an early entry for the insurance company. according to MarketSmith Analysis. The RS line of WRB is at a high level.

The ‘most predictable’ Fed recession in history could come

Market Rise Analysis

The stock market rally saw a strong advance on Thursday, with significant gains on all major indexes.

It is worth noting that the trading volume on the Nasdaq increased slightly compared to Wednesday. The volume of the New York Stock Exchange decreased slightly.

The Dow and the S&P 500 moved above the 21-day moving averages, along with the Russell 2000. The Nasdaq was not quite there, but crossed the 10-day line and moved above a short-term range.

After the 21-day line, the major indicators are facing resistance at the 50-day and 200-day lines. a force direction There is still a long way to go. The current market rally may fade long before then.

The market showed a strong expansion on Thursday. With no major companies in a position to lead at the moment, a sustainable market rise will require widespread advances.

Retail traders had a strong trading session and were the main driver of market gains on Thursday. But most of them are still badly damaged and need a lot of repair. The only exception, perhaps, is the stock DLTR. Dollar Tree jumped 22%, came back above the 50-day line and the trend line, recovering all of its losses caused by last week’s surprise. Goal (TGT) warning. However, the work of the bungee cord chart over the past week is not normal.

Energy stocks had a strong session with the sector remaining a clear area of market strength. Drugmakers look solid, while lithium plays like ALB stock.

Traveling plays like DAL’s Arrow were starting to look interesting but were prone to turmoil. Some steel plays bounce back.

While rickety growth stocks were among the big gainers on Thursday, they are still fraught with risks. If the market declines, they will be among the biggest losers.

Time to Market with IBD’s ETF Market Strategy

What are you doing now

Investors can enter the market, either through individual stocks or broad market ETFs. While some individual names flash buy signals, there are many in the energy realm. But you don’t want to get too exposed to any one sector, even energy.

If this market rally has legs, you can steadily increase exposure as more names flash with buy signals. If it’s another short-term advance, you’ll need to get out quickly.

Get your watchlists in shape. Look for ready stock, or thereabouts. But you can also track the names of the quality whose preparation began.

Read The Big Picture Every day to stay in sync with the trend of the market, stocks and leading sectors.

Please follow Ed Carson on Twitter at Tweet embed For stock market updates and more.

You may also like:

Do you want to get quick profits and avoid big losses? Try SwingTrader

Best growth stocks to buy and watch

IBD Digital: Unlock IBD Premium Stock Listings, Tools & Analysis Today

Bear market news and how to deal with a market correction

China EV giant flashes early buy signal as it seizes Tesla crown

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

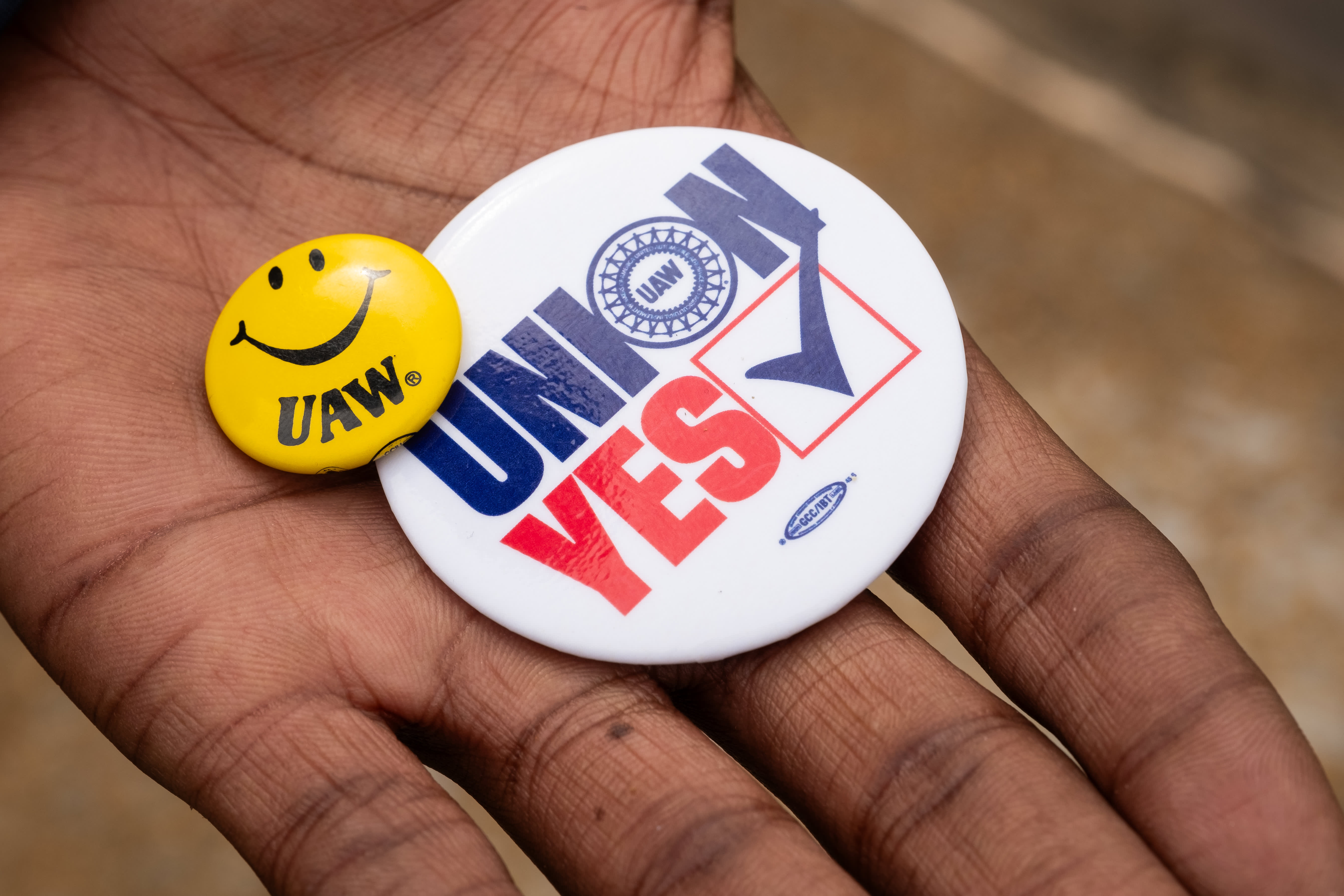

Volkswagen workers in Tennessee vote to join the UAW in a historic win for the union

Netflix stock falls on disappointing revenue forecasts, move to scrap membership metrics

The price of Bitcoin (BTC) has risen as the halving approaches