(Bloomberg) — Cisco Systems Inc has scared investors by warning that Chinese shutdowns and other supply disruptions will wipe out sales growth in the current quarter, renewing broader concerns about technology spending in a fragile economy.

Most Read From Bloomberg

The outlook sent Cisco shares down as much as 19% in late trading and weighed on other network stocks, dealing a fresh blow to an already battered sector. Even before Cisco’s latest plunge, its stock is down 24% this year.

The question for most of Wall Street was whether Cisco’s expectations meant customers were cutting spending, but the networking equipment giant said supply problems — not downsizing — were the main problem.

“Although those top line numbers don’t look good, there is a very simple explanation,” CEO Chuck Robbins said on a conference call with analysts. Customers are not signaling any real transformation at this point. There is no reflection of demand issues in our guidance.”

Cisco is the largest maker of the machines that power corporate networks and form the backbone of the Internet. Investors view its outlook as a proxy for corporate spending on infrastructure, which is why the sudden turnaround has been particularly alarming.

The company had expected growth in the current quarter of about 6%. And it said Wednesday that sales will actually fall 1% to 5.5% in the period ending in July. Cisco’s earnings expectations were also lower than Wall Street’s expectations.

Cisco shares fell to $39 in late trading. That followed a 4.4% drop in regular trading Wednesday, bringing the stock to $48.36.

Other network-related companies saw their shares fall hours after the Cisco report was released. Juniper Networks Inc.’s stock fell. By 9.6%, Broadcom Corp is down 4.3%, and Ciena Corp is down 12%.

Covid-19 lockdowns in China have disrupted supply lines, hitting companies ranging from Apple Inc. To Texas Instruments Inc.

Like many tech companies, Cisco began cutting ties with Russia after that country invaded Ukraine earlier this year. The company said on Wednesday that halting business in Russia and its ally Belarus cost it about $200 million in revenue during the third quarter of the fiscal year. Historically, the region, including Russia, Belarus and Ukraine, accounted for about 1% of total sales.

In the conference call with Cisco executives, analysts questioned whether the weak guidance indicates that customers are concerned about their future prospects and have begun to cut back on their spending.

Robbins insisted that demand remains strong. However, the company does not expect the supply shortage to be resolved in the current quarter.

The inability to source power supplies from China cost Cisco $300 million in revenue in the third quarter, executives said. And even when China’s lockdowns end, the problem won’t be resolved right away.

The tone of the report was a stark contrast from three months ago, when Cisco said orders rose more than 30% for the third consecutive quarter. Since then, investors have become more concerned that inflation and fears of slowing economic growth will make customers more cautious. In the last quarter of last year, the company said it increased orders by 8%.

While that’s a much slower rate of expansion, it shows solid growth going forward for a company the size of Cisco, according to David Heeger, an analyst at Edward D. Jones & Company.

“I would be more concerned if the order number was flat or down,” Heger said.

Cisco has implemented a no-cancellation policy on its orders within 45 days of shipment, according to CFO Scott Hearn. Smaller customers, who tend to be the quickest to tighten their spending budgets, increased orders by 19%. Herren said in an interview that the growth and low overall rate of cancellations give the company confidence that there are no underlying issues with demand.

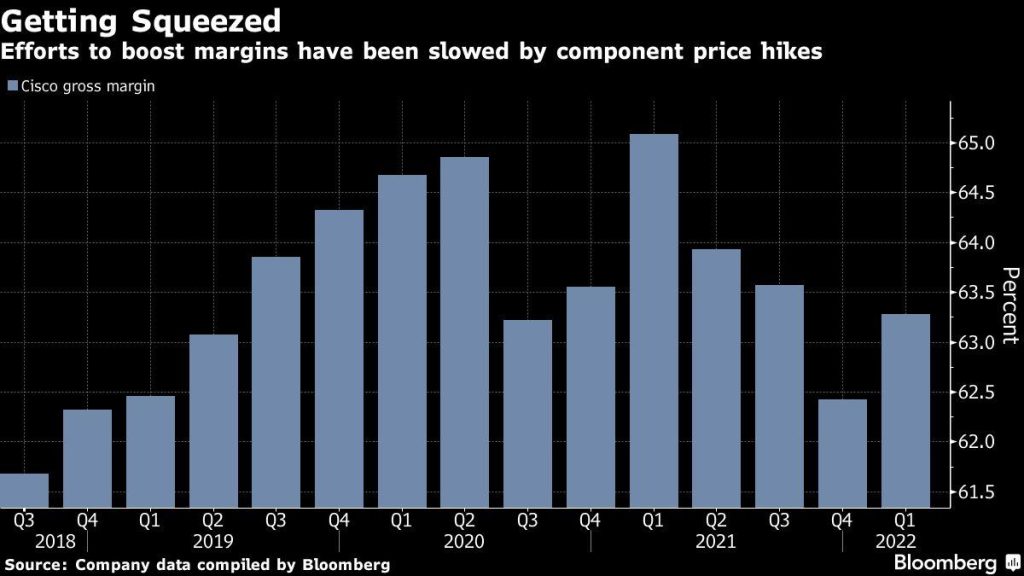

Under Robbins’ leadership, Cisco has been trying to spur growth with updated hardware, as well as new services and software. The hope is to make the king of networking equipment for a long time less dependent on one-off equipment sales.

Recent forecasts point to a setback in that batch. Cisco said that, excluding some items, earnings will range between 76 cents and 84 cents a share in the period. That compares to an average estimate of 92 cents.

For the year, the company said, revenue will grow 2% to 3%, compared to a previous forecast of 6.5%.

Revenue in the three months to April was $12.8 billion, little changed from a year ago. Earnings per share, minus some items, were 87 cents. Analysts expected a profit of 86 cents on average sales of $13.3 billion.

Without signs that orders really are slowing, Heger said, Wall Street may be overreacting to Cisco’s numbers.

“Except for some significant drop in demand, the market appears to be overcompensating,” he said.

Most Read From Bloomberg Businessweek

© Bloomberg LP 2022

“Unapologetic reader. Social media maven. Beer lover. Food fanatic. Zombie advocate. Bacon aficionado. Web practitioner.”

More Stories

ASML earnings drag semiconductor stocks lower

United Airlines jumps after results beat “significantly low” expectations.

Boeing is in the spotlight as Congress subpoenas a whistleblower to testify about flaws in the planes